startup tandem

STRATEGIC MANAGEMENT CONSULTING

Helping Gen Z and millennials scale from STARTUP to ENTERPRISE.

Strategy Development

From go to market to efficient operations and value growth strategies.

Operations management

1MM + Cost Savings

We’ll pinpoint actions to reduce overall spending.

Increase Enterprise Value

We’ll identify areas for improvement and develop an action plan to increase value over time.

Businesses Trust startup tandem For Financial & Business support

Fractional CFO

Carefully vetted CFOs to grow and manage your business.

Accounting

We are a leader in accounting and bookkeeping.

HR consulting

People, culture, and HR consulting to help you scale.

State & Federal Taxes

Expert tax advice, filing and support.

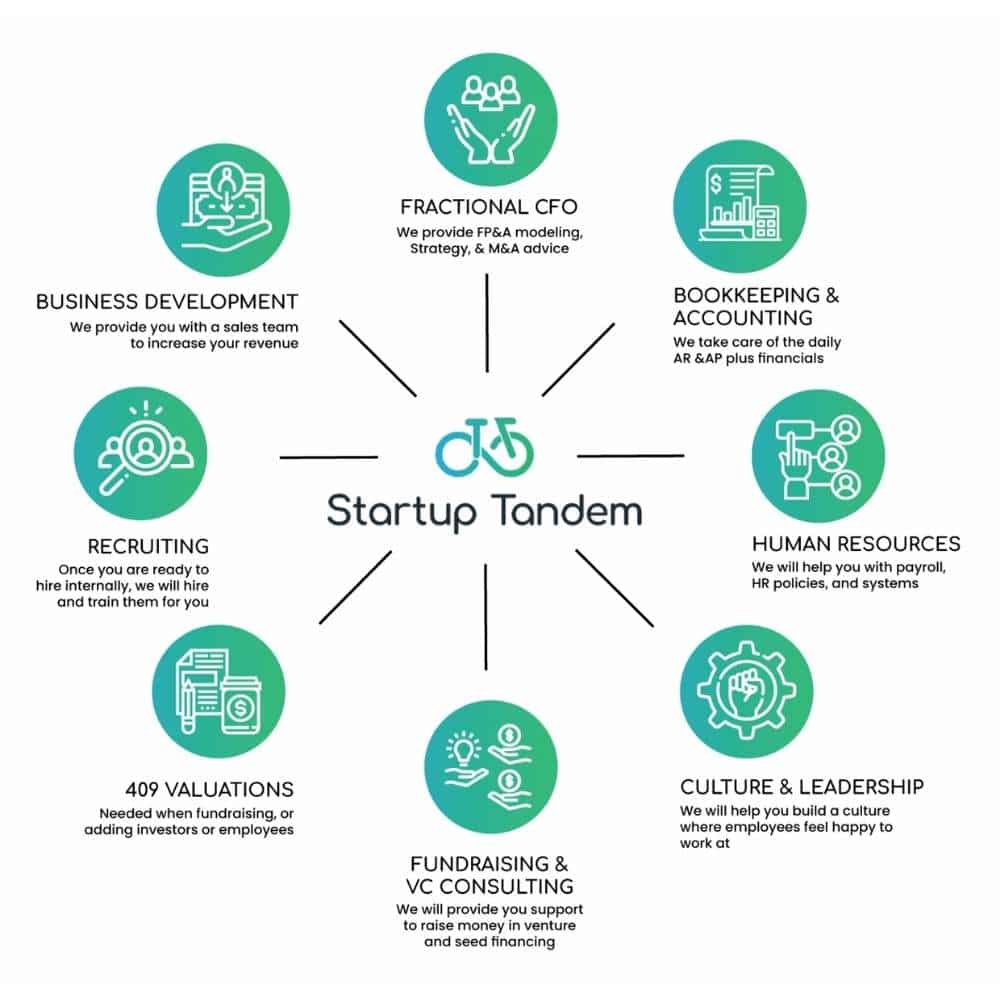

What Is Startup Tandem?

Startup Tandem is a consulting group focused on helping business owners scale from a startup to an enterprise. We offer services like COO, tax, CFO consulting, and accounting services for businesses like yours! We do this by providing valuable professional consulting services that meet your business needs. Startup Tandem believes in using unique, pricing structures that enable businesses to receive more valuable services for a fixed price (rather than billable hours). This enables us to provide better service and for the client to obtain more value from us. Get started with Startup Tandem with strategy development & execution, and increase your business value and profits.

Thousands Of Success Stories!

Startup Tandem has thousands of client success stories. Here’s why startups trust us with financial and accounting consulting.

Great Partner & Financial Support

Alejandra has been with us for over a year and through a few transitions to support our financial needs as an early startup…

Jen

CEO/Founder, Betr Remedies

What Every Startup Needs!

Best Financial Partner Out There!

I have been with this company for a few months and during our monthly meetings they have showed me where I can make improvements. They are very involved…

Alex Ras

Specialized Business Services For A Range Of Industries

CPG

You will spot our clients at Whole Foods, Target, Costco, and Walmart. We provide trade spend solutions to help you bring more cash to the bank.

SaaS

Our clients create platform solutions for payment transactions, event planning, and many more.

Crypto

We work with startups in blockchain technology, NFTs, and exchange transactions.

Law Firms

We help law firm with accurate recording, and reporting of the operations.

eCommerce

We help our clients that sell online thru Shopify, Woo-commerce, or Amazon with proper revenue and inventory reporting.

Dentists

We help dentists stay compliant with payroll and HR related issues.

What We Do For Businesses

Startup Tandem: Fractional COO, Fractional CFO, Accounting, and advisory service. Providing finance and business services to small businesses and startups, with you from beginning to EXIT.

Startup Tandem scales as your business scales. No matter what your situation – we meet you where you’re at!

A Few Of Our Partners

Industry News

Cracking the Code: Empower Your Business with the Art of Bookkeeping!

In the intricate world of finance, where numbers dance delicately under the watchful eyes of spreadsheets, one profession emerges as both the guardian and maestro of numerical symphony. Enter the art of bookkeeping—a meticulous craft that ensures the fine balance...

Master Your Taxes: Simplify Your Tax Filing Process & Maximize Your Refund

Tax filing process can be overwhelming, confusing, and time-consuming. With numerous forms, deadlines, and complex regulations, it's no wonder that many individuals dread facing their tax returns each year. The burden of understanding the ever-changing tax laws,...

Unearthing Success: 4 Mind-Blowing Secrets to Forming a Business Empire

Have you ever wondered how the most successful entrepreneurs build their vast business empires? What are the secrets behind their extraordinary accomplishments? Well, if you're looking to unveil the curtains and delve into the hidden world of business formation,...

Check Out Some Of Our Videos

Startup Tandem is committed to providing you with important knowledge, tools and tips to help your startup grow. Follow us on YouTube to stay informed and make better financial decisions. We're always offering valuable information and tips for your startup!