Updates on Domestic and Global Economic Outlook – May 2022

Takeaways: –

- FOMC, or Federal Open Market Committee has projected a 2.8% rise in GDP in 2022, along with a 2.2% rise in 2023, and a 2% rise in 2024 from the information gathered at the meeting on March 16, 2022

- The FED, or Federal Reserve reported an estimated unemployment rate of 3.5% for 2022. The rate is expected to remain stagnant in 2023 and increase to 3.6% in 2024

- BLS, Bureau of Labor Statistics, is predicting the level of employment to increase by 11.9 million jobs between the dates of 2020 and 2030, which factors in the pandemic and the effects it’s had on employment, as well as structural change within the economy due to an aging population of Americans.

- The Federal Reserve Board reports that the core inflation rate is to be 4.1% for 2022, then reducing to 2.6% and 2.3% in 2023-24 respectively. The ideal inflation that the FRB is targeting is 2%

- As inflation rates increase, the buying power consumers have is reduced, as product costs rise without a rise in income.

- For the first time since 2018, the Federal Open Market Committee is raising rates, to combat inflation rising. The overall increase was 25 basis points, going from 0% to 0.25% then again to .50%.

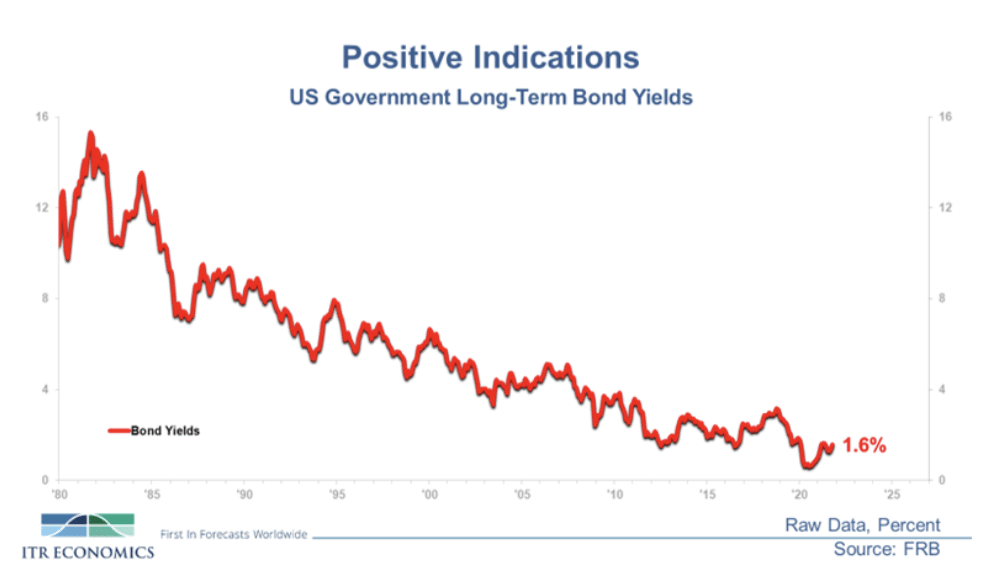

- In an attempt to stop inflation from rising, on the 4th of May 2022, The Committee raised the target range of the Fed Funds Rate from .75% to 1%, and expects continued increases in the target range will come. Along with this, the FOMC will start to reduce its holding of treasury securities, agency mortgage-backed securities, and agency debt as of June 1. This is in the Plans for Reducing the Size of the Feds balance sheet that was issued alongside this statement. (refer to Chart 1)

PRO TIP: Please read our article on the importance of consumer confidence. We know you’ll enjoy it.

Industrial Reviews: –

- Consumer Packaged Goods, or CPG

- The global CPG market is expected to reach $2382260 million US dollars by 2027, an increase from $1938120 million US dollars in 2020, at a compound annual growth rate of 3% through 2021-2027, as reported by Global News Wire.

- US Consumer Packaged Goods industry expanded 3% in 2021, according to IRI,

- The supply restrictions that affected competitors allowed small consumer packaged goods to enlarge their market share (as shown in Table 2)

- The bottlenecks within the supply chain are being cited as the main force behind the rise of inflation and has been forecasted to ease into a slower pace.

- Technology

- The technology market within the United States makes up 35% of the total marketplace worldwide

- The United States tech industry is estimated to reach a TMV of $1.6 Trillion by the end of 2021

- The U.S. technology sector has contributed roughly 1.8 Trillion dollars to the country’s GDP, taking up a space of 9.3% of the total GDP for 2021

- 7.9% of the workforce within the US is contributed to Tech employment

- The overall budgets of tech companies are anticipated to increase in 2022

- There are three high-growth areas of technology, according to Zippia: Virtual Reality, Blockchain DeFi, and Artificial Intelligence

- Zippia also cites Blockchain DeFi has a compound annual growth rate thru 2025 of 67.3%, while AI is at 40.2% and VR is an astounding 100% compound annual growth rate

PRO TIP: Read this article to learn whether or not your startup really needs a bookkeeper.

Chart 1

This chart shows the bond interest rate changes of the US long term bonds. The rate has stayed rather low and stable, showing that it hasn’t responded much to current volatility or inflation. This is an predictor that current hikes of the interest rates are a piece of monetary policy action to curb rising inflation in the coming future, per Fisher’s investment analysis. Based on the holding of the long term bonds within the market, market volatility is expected to ease after mid term elections in November of 2022.

PRO TIP: Read our article to learn who to hire for startup services.

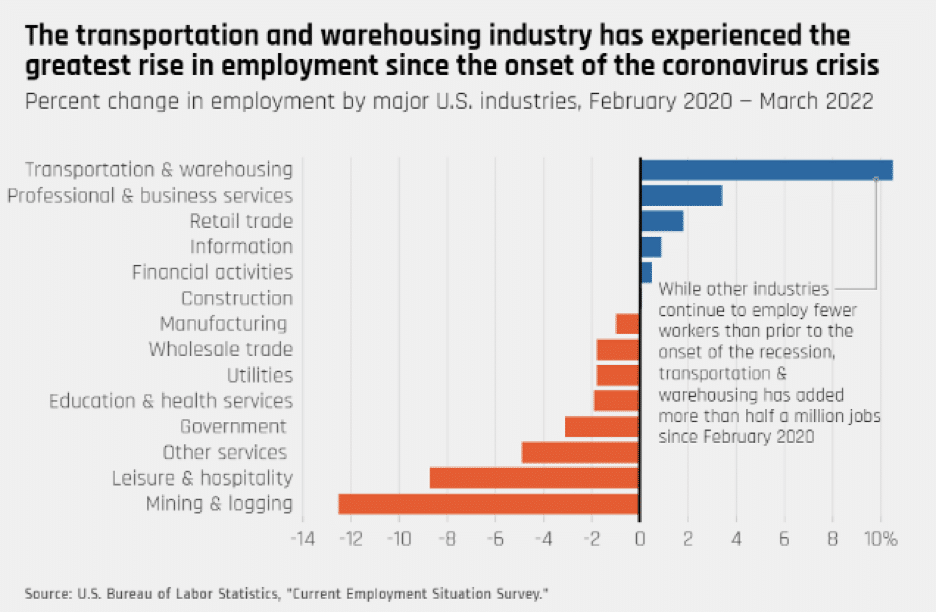

Chart 2

Economic trends in 2022

- Digital transformation is changing the world, and also the economies within

- Drivers behind global growth include Asia and emerging markets

- The demographics that impact the costs of healthcare are changing

- Fiscal and Monetary intervention are rising

- The workforce and what drives them is rapidly changing

- ESG projects are changing how the economy operates

- SPACs are becoming mainstream

In summation of all that has been mentioned, the pandemic in 2020 has caused a series of issues that have risen inflation and as a result, volatility of the economy is seen both within the U.S. and abroad. All eyes are on midterm elections and geopolitical concerns as uncertainty of the future grows ever closer. The market has pre-priced in opinions and the biggest driver of the future of the marketplace is how consumers feel about it.

Please reach out to us at Startup Tandem with any questions you may have. We look forward to hearing from you.